Investing real estate in Medellin – Colombia in 10 steps

Intrigued? Before moving forward, there are several important considerations investors should take into account before buying real estate in Colombia.

Next we will give you a step by step of what you must do to buy real estate in Colombia

Step 1: Travel to Colombia.

Whether eager to buy today or undecided about purchasing property in Colombia, urge prospective investors to visit different parts of the country and make sure the reality matches individual expectations.

In Colombia, you can rent a local apartment in the city you plan to move to or invest in and get a feel for the local environment. If you are not familiar with other Colombian cities, take the time to explore them and see how each compares.

Step 2: Choose a city.

Visiting Colombia will prepare investors for the next step: choosing a city. Investment opportunities can be found throughout Colombia, but the big four Bogota, Medellin, Cali, and Cartagena offer some of the most promising.

Medellín, also known as the City of Eternal Spring, enchants with its eternally spring like weather and fascinating history, and it is the one we are inviting you to get to know today.

Step 3: Choose a neighborhood.

After exploring the ins and outs of their new city, investors are ready to decide where they want to live. Many of Colombia’s cities including its four main destinations are divided into neighborhoods, each of which has a distinctive character.

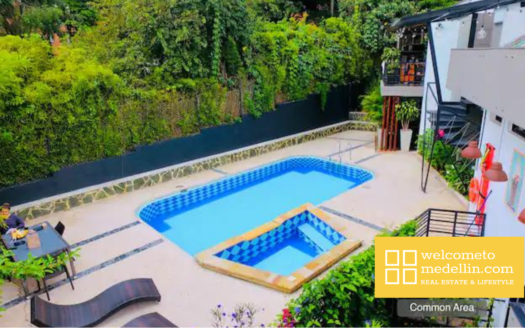

Below, we’ll talk about some of our favorite neighborhoods in Medellin.

Medellin is one of the cities preferred by foreigners and has several popular neighborhoods. The first of these is Poblado with its nightlife, upscale restaurants, and shopping is one of the top choices. However, some digital nomads and young professionals prefer Laureles and Envigado.

Step 4: Hire a local bilingual team.

When it comes to finding your ideal property in your preferred city and neighborhood, we emphasize the importance of finding a trusted team that is familiar with the local market and Colombian real estate regulations. We recommend forming a local, bilingual team consisting of the following.

A real estate agent. Especially for investors who are not fluent in Spanish, it is highly advisable to find a bilingual agent. A local agent can help buyers find a property that fits their requirements for location, amenities, Price, and investment potential, and then help negotiate terms with the seller.

A real estate lawyer. In addition to a local agent who speaks English, investors need to seek the guidance of a bilingual lawyer. In Colombia, contracts must be written in Spanish to be considered legally binding. The attorney will help draft the sales contract, conduct a title search, ensure that the buyers’ funds are properly registered with the Central Bank, and draft the terms and conditions for closing.

Step 5: Make an offer.

With the support of a local team, investors will be ready to begin the process of making an offer for the desired property. In the initial negotiation, the investor team and the seller will agree on the price and terms of the purchase contract. Working with a strong professional team, the investor can then negotiate what is included in the price – such as parking, appliances, furniture and fixtures, and storage – in addition to closing costs, down payments, and other important terms.

Step 6: Title diligence.

Once the initial offer is accepted, it is essential to work with an attorney to make sure the title to the house is clean and clear to avoid any legal problems. While Colombia has experienced tremendous growth, there are some lost properties purchased with “dirty” money that remain as relics of the country’s tumultuous past. A local attorney can help investors gather and review documents for due diligence, including Certificado de Tradición y Libertad.

This document includes a list of the former owners, plus any debts or legal claims against the property.

Public Deed. This is the title deed that indicates your address, your real estate registration or public lot number and any restrictions on the sale.

Paz y Salvo Predial. This document certifies that the municipal taxes on the property have been paid.

Paz y Salvo de Valorización. This document certifies that the taxes related to the increase in value of the property have been paid.

Step 7: Sign a Promise to Purchase and Sell.

If the investors decide to go ahead with the purchase, their attorney will draft a Promise of Sale. This contract should state the final sale price and important conditions, including:

- Payment terms, amounts, and dates.

- Any remaining commissions, fees, or taxes to be paid.

- Proration of utilities

- Proration of rental income if there is a tenant.

- Penalties for default by the parties

Upon signing the pledge, investors may be required to provide a down payment. Down payments can vary in size but are typically around 10% of the sales price.

Step 8: Transfer the money to a bank account.

To obtain investor status and to have their funds legally registered in the country by the Central Bank of Colombia, the Banco de la República de Colombia, investors normally need to transfer the money from their foreign account to a Colombian brokerage bank account. Please note that it is very important to register the funds correctly as a foreign investment using Form 4, as this will allow you to repatriate the money in case you sell the property. We strongly recommend that you work with a lawyer to do this.

Step 9: Sign the new Title Deed.

After the day of closing, it may take a month or more for the Colombian government to officially transfer the property. Once the month has elapsed, the new owner will receive the new public deed. Once the deed is signed and notarized, the investor is officially confirmed as the new owner of the property.

Step 10: Obtain a visa.

Investors who wish to remain in Colombia and establish residency may do so by obtaining a resident, or “R” type visa. With a qualifying investment of at least 650 times the Colombian minimum wage, investors can apply for a five year visa that can be renewed every five additional years.

Investors may also opt for the option of a three year renewable investment visa for 350 times the minimum wage or for 100 times the minimum wage can invest in a Colombian company.

Last words

With this, we have finished and hope that the whole process has been clear to you, however, if you have doubts you can leave us your comments below or send us a message and we will contact you as soon as possible.

Hi, I'm Joey, and I'm here to help you find the perfect place for you.

Still don't know whether to purchase or rent?

Write me on WhatsApp or leave me your contact information and I will reach out to you as soon as possible.