Investing dollars in Colombia, real estate is a profitable opportunity!

The U.S. currency is a global benchmark for international transactions. However, it can also be useful for investments within the country. Therefore, today we will talk about the opportunities to invest dollars in real estate in Colombia.

But before looking at the opportunities, we will talk about the behavior of the currency in recent months, addressing some of the possible causes of this behavior.

What do you need to know to invest dollars in Colombia at this time?

Currency markets are characterized by their dynamic activities. Thus, the values that are registered change from day to day.

These changes are due to financial, macroeconomic, political, news or technological factors, among many others.

From 2020, another factor will be added to this list. The pandemic caused by the new coronavirus shook the main world economies. As a result, currency markets are reacting.

An upward trend that continues

Colombia has experienced a rise in the dollar that shows a certain tendency to continue increasing. A sample of this can be seen in the following image, which shows the variation of the Market Representative Rate (MRR) for the last 6 months.

Specifically, on june 16, 2020, the TRM stood at 4,016.82 Colombian pesos per dollar. It rose slightly to 4,105 .

Since that month, it has been rising until today, October 10, at 4,605.

June: 4,016

July: 4,198

August: 4.337

September: 4.532

The graph also shows a trend that seems to repeat itself: after each peak comes a certain stabilization and a decline in the value. This lasts for a few days (about a month) and then shoots up towards the next peak.

Two trends can be deduced from this data: that the peaks are getting higher and higher (note how they increase each time) and that the valleys are also getting bigger and bigger.

To put it concretely: if you bought a dollar on December 17, 2020 and sold it on May 5 of that year, you earned 436 pesos!

Real estate as an opportunity to invest dollars in Colombia

The real estate sector becomes an attractive option for Colombians who earn dollars, either because they live abroad, because they have businesses in other countries or because they receive remittances.

It is also attractive for foreigners who come to Colombia with the intention of making the most of the dollars they bring with them.

Real estate has a competitive advantage over other sectors of the economy: its relative price stability.

Seen from this perspective, real estate in Colombia costs less and less dollars.

For example: imagine a property with a value of one billion pesos, which has remained stable in the real estate market between December 2020 and May 2021.

While on December 17 it would have cost you $293,184, the same purchase would have cost you $259,991 on May 5, 2021.

In other words: in almost 5 months, you would save more than 33 thousand dollars! The increase in the TRM alone makes dollars yield more and more on Colombian soil. And if these are the figures for a single imaginary property, imagine the amounts that can be reached with larger investments!

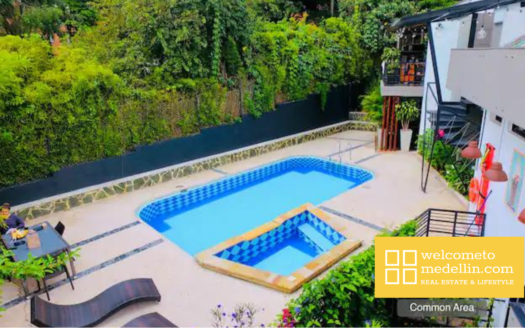

New developments: attractive for investing dollars in Colombia

Colombia has become an interesting country for foreign investment. Its strategic location in the continent and its modernization processes are attractive in the geographical and economic context of the region.

The rising trends in the dollar favor these investors.

Some of them arrive in the country with their project plans rolled up under their arms; others, with binoculars in their pockets.

The former bring their development ideas and seek to implement them. To do so, they contact the construction sector and allocate the necessary resources to execute their projects.

The latter arrive in search of opportunities. These people invest in projects that are already under development or construction. This allows them to expect an interesting return when these projects are sold to the public.

Investing in dollars as a way of securing wealth

Not all people who invest in dollars do so with the intention of making a profit.

There are those who live abroad but have their family in Colombia. For them, their priority will be for their family members to have an appropriate home, or to improve the existing one.

In this aspect, the rise of the dollar also favors. The investor will need to raise fewer dollars to acquire the new property.

On the other hand, in the case of exchanging for a better house, there are two advantages: the pesos received for the old house serve as part of the payment for the new one, while the surplus in dollars will be lower.

To sum up…

Whatever the interest in investing dollars in Colombia, real estate is an excellent option in times of upswing. Investments require fewer and fewer dollars and remain solid and stable over time.

If you are interested in knowing real estate projects to invest your dollars, contact us! At AV Group Propiedad Raíz we will advise you according to your needs.

Last Words

We hope you enjoyed our blog and if you did click subscribe, share and subscribe to our social networks. Check below for more content and be sure to sign up for our newsletter.

Hi, I'm Joey, and I'm here to help you find the perfect place for you.

Still don't know whether to purchase or rent?

Write me on WhatsApp or leave me your contact information and I will reach out to you as soon as possible.